摘要:(1)超额抵押首先USN使用NEAR和USDT进行双重抵押,即使NEAR崩溃,抵押品的价值也将永远超过USN的总流通量。、USN的设计将增长和稳定性作为同等优先事项,并且DecentralBank将继续支持这一目标。...

Disclaimer: This article aims to convey more market information and does not constitute investment advice. The article represents the author's views and does not represent the official position of Mars Finance.

Editor: Don't forget to pay attention!

Source: Ostrich Blockchain

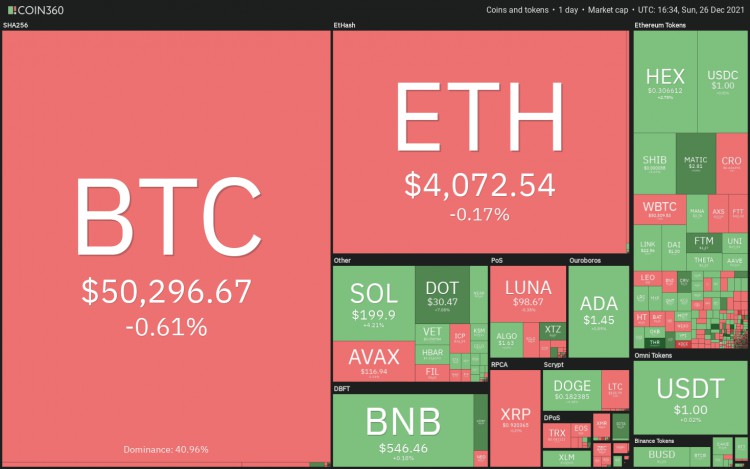

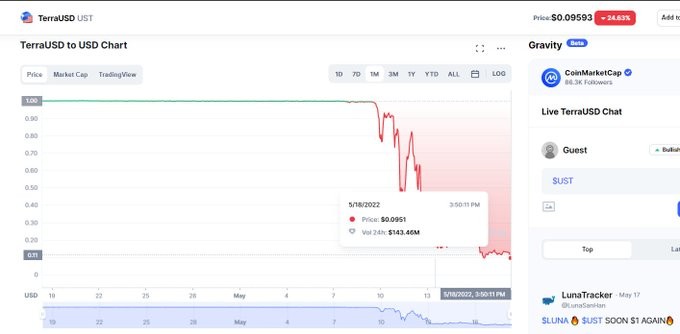

Recently, we have witnessed a giant in the algorithmic stablecoin world - UST, facing collapse. When Terra entered a death spiral, UST went off-peg, and the price of LUNA plummeted overnight. This has forced industry insiders to reassess the risks in the algorithmic stablecoin market. So, how does USN/NEAR, similar to UST/LUNA, ensure that it can prevent a similar tragedy from happening again?

This article will help you understand the major differences between USN/NEAR and UST/LUNA. Although USN and UST are both algorithmic stablecoins, USN can prevent the same tragic event that UST encountered.

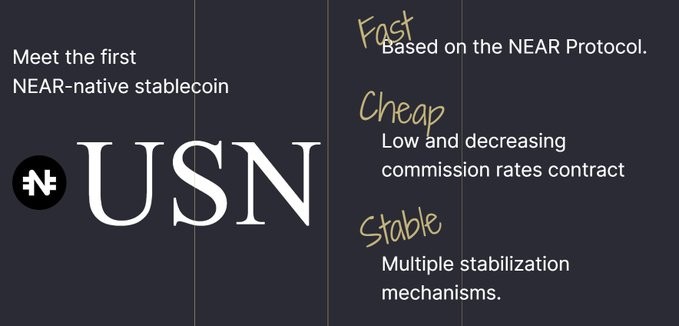

1. Intelligent Mechanism of USN

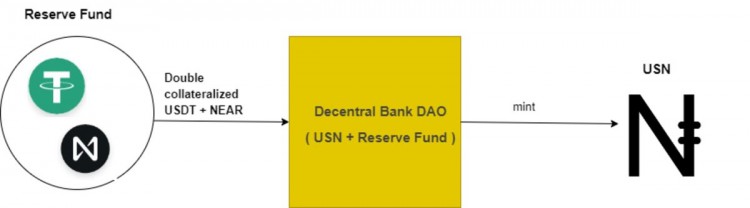

First, let's understand how USN works. The stablecoin USN is over-collateralized, combining on-chain arbitrage with a reserve fund, which is doubly collateralized with NEAR and USDT. In case of the worst-case scenario, the Decentral Bank can repurchase all previously issued USN.

How does USN maintain stability?

(1) Over-collateralization

First, USN uses double collateralization with NEAR and USDT, ensuring that the value of the collateral will always exceed the total circulation of USN, even if NEAR collapses.

(2) Automatic reserve fund rebalancing

To maintain a collateral ratio of over 100%, the reserve fund will automatically rebalance excess NEAR reserves with stablecoins like USDT.

(3) Conservative collateral strategies

Only battle-tested stablecoins can be used to collateralize USN, such as USDT. The Decentral Bank will deposit these stablecoins into a stability exchange pool to maintain the stability of USN in the open market.

USN's design prioritizes growth and stability equally, and the Decentral Bank will continue to support this goal.

2. USN has a more sustainable mechanism than UST

By combining UST's price stabilization mechanism with a reserve fund based on the Frax Currency Board, USN has a more intelligent and sustainable operational mechanism than UST.

The difference here is that when 1 US dollar's worth of LUNA is tokenized into 1 US dollar's worth of UST, the 1 US dollar's worth of LUNA will be burned, instead of being deposited into the protocol's reserve fund when minting USN like NEAR does. According to the Monetary Bureau's principles, this ensures the sustainability of USN.

Therefore, USN can effectively increase the liquidity of the NEAR ecosystem and increase the utility of NEAR tokens while maintaining its stability. The smart contracts and reserve fund of USN are managed by the Decentral Bank DAO.

Additionally, the collateral rate of USN is variable, determined by a self-adjusting mechanism. When the NEAR price rises, the collateral rate for USN also increases, and vice versa. This design maintains the stability of the USN exchange rate and effectively avoids many crises.

3. USN is just getting started and has not entered the FOMO phase

USN is just getting started and has not entered the FOMO phase yet, but even so, NEAR must consider every worst-case scenario carefully.

The reserve fund for USN is built from scratch as double collateral (2:1) - 100% of USN can be collateralized with NEAR and other stablecoins. In the initial stage, this design gives USN better liquidity and stability than UST. It is worth mentioning that, after the failure of UST, Terra plans to rebuild a new Terra with a new UST coin, and collateral mechanisms like DAI will be implemented, shifting their focus from scalability to stability and recovery.

After the recent stablecoin crisis, Near is likely to adopt such a mechanism to strengthen its stability.

4. Stability of the NEAR Protocol Ecosystem

For Terra, a non-EVM blockchain, it is quite difficult to develop and migrate dApps from other ecosystems, as the key products of dApps mainly revolve around DeFi centered on UST.

For NEAR, however, the success of the Aurora-NEAR EVM project has attracted more excellent development teams to enter the NEAR ecosystem. This has made the NEAR ecosystem more prosperous, with many dApps in different service areas. This contributes to better sustainability of the NEAR ecosystem.

Furthermore, thanks to EVM, major stablecoins such as DAI, USDT, USDC can easily integrate and support the NEAR ecosystem. Additionally, NEAR is fundamentally the first blockchain platform to apply Sharding technology in the blockchain, a new technology that has yet to succeed. This is also a major reason for NEAR's continuously growing value.

In summary, USN and NEAR have not yet reached the bubble state, and it can even be said that everything about USN is still in its early stages, ensuring many mechanisms and opportunities for improvement in the development potential of USN/NEAR. Especially with the help of EVM, it is much easier to obtain support from external resources.